MYRULES.APP

COMPANY AS A SERVICE

No paperwork

No corporate accounting

Tax payout optimization

01.

VALUE PROPOSITION

Why MyRules

With MyRules you can easily get paid and invoice your customers. Just focus on your business without dealing with the bureaucracy of running your own company while increasing your profits.

Forget paperwork and bureaucracy

Cheaper and more efficient than your own company

Reduce tax payout and accelerate your business growth

Issue fully compliant invoices from a VAT registered company

02.

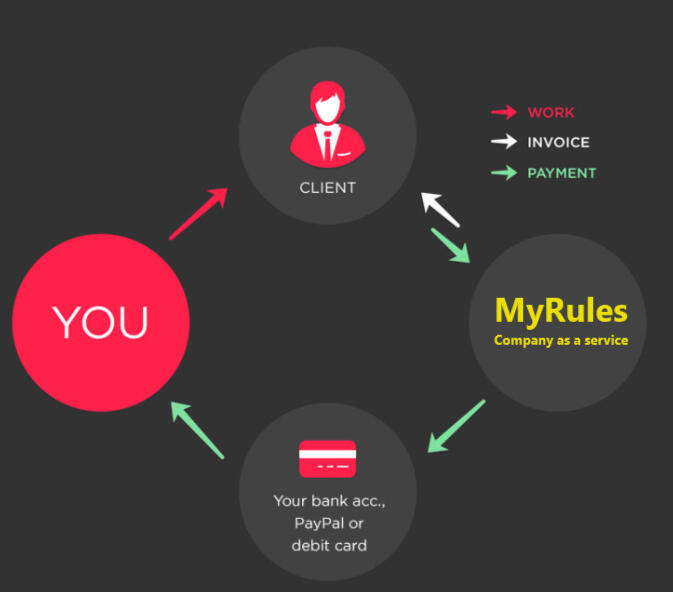

How it works

Step by step with MyRules. Start invoicing as a company in just 10 min

Create an account

Send invoices to your clients from MyRules

The customer pays MyRules

Withdraw money to your bank account

03.

MyRules features

WE DON'T match corporates with digital freelancers for new projects.

You remain in full control of your customer pipeline, rate negotiation and project scope.WE DO offer a SaaS platform:

Improved business trust

Centralized customer directory

Issue invoices and receive payments

Payout as Personal income

24/7 Support

Personal taxation only on MyRules withdrawals

Freelance subscription service

You rule when paying personal taxes

No cost related to business management

No state fees or corporate tax

Not need to change your country of residence

No business, just cancel your subscription

Pricing

59€/month 99€

Fixed monthly subscription

No long term commitment

Unlimited number of invoices

Unlimited number of withdrawals

24h SEPA transfers

Bank fees when applicable will be charged separately at cost

| Frequent Q&A | |

|---|---|

| How are the assets secured? | Dedicated bank account at Revolut Bank UAB |

| How is tax payout reduced? | Personal taxation only on withdrawn amount |

| Can I invoice any country? | Yes, MyRules invoices are universally accepted |

| What kind of services can be invoiced? | Digital freelance services location independent |

© MyRules. All rights reserved.